Online platforms are filled with individual customer reviews, offering only a glimpse into one person’s experience. To truly grasp the sentiments of the broader consumer base towards Canada’s largest insurance providers, a significantly larger sample size is necessary Best overall car insurance.

That’s why RATESDOTCA conducted a comprehensive survey involving over 8,875 drivers in Ontario and Alberta. We asked them to rate their insurance companies across various key areas. Best Overall Insurer, Most Trustworthy Insurer, and Best Claims Experience, Best overall car insurance. Below are the criteria our survey respondents used to evaluate their insurers:

How we got this ranking

- Trustworthiness: This segment examined whether an insurance company delivers value for the premiums paid and if its products meet the current needs of drivers.

- Claims Experience: We inquired about the ease of filing a claim with a company and requested ratings on the quality of service received. For instance, was the process well-explained, and was the resolution prompt?

- Policy Documents: We assessed whether insurers in Canada present policy coverages (and exclusions) in an easily understandable manner, and if they indicate who to contact in various scenarios.

- Billing Statements: We sought feedback on whether Canada’s insurers issue bills that are straightforward to comprehend. Are the premium amounts and payment schedules clearly outlined?

- Customer Portal/App: The functionality and design of an app can significantly influence one’s opinion of an insurance company. We asked customers if their insurer’s app made tasks easy to complete.

Scores from each category were averaged to determine the best overall score, with a margin of error of +/- 1.01%. For further details on our methodology for the Best Home and Auto Insurer Awards, please visit our website.

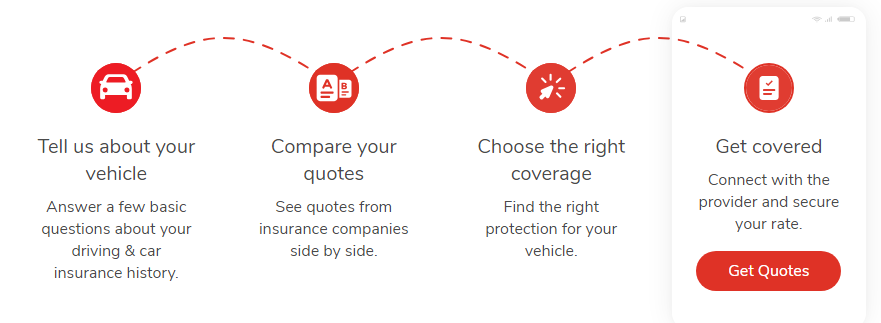

How to use RATESDOTCA to get the cheapest car insurance rates

- Advertisement -

RATESDOTCA’s Best Home and Auto Insurer Awards 2024

In today’s landscape, securing a favorable price on car insurance holds significant importance. However, when you’re in the market for insurance, price isn’t the sole consideration. Understanding whether your chosen provider has a proven history of supporting policyholders during crucial times is vital – and this goes beyond mere pricing.

To determine which insurance companies truly deliver value for their premiums, we sought insights from the real experts: fellow drivers like you.

We gathered candid feedback from nearly 9,000 drivers based in Ontario and Alberta. Below, you’ll discover the companies that received top ratings across categories such as convenience, customer service, and claims resolution.

Best overall car insurance companies

- CAA Insurance

- Northbridge

- Wawanesa

CAA Insurance has achieved the highest overall score, standing out as a leader in trustworthiness, product offerings, customer service, and environmental consciousness, all while offering competitive rates to its customers.

Drivers have also given their endorsement to the runners-up, Northbridge and Wawanesa.

Northbridge customers have given high ratings for the company’s claims service, noting that claims agents are proactive and well-versed in their knowledge.

Wawanesa’s customer portal and app have received positive feedback as well. Additionally, policyholders trust Wawanesa to handle claims with efficiency.

Related Keywords:

- Best car insurance canada

- Car insurance canada cost

- Cheapest car insurance canada

- Car Insurance 2024

- Car insurance canada compare

- buy car insurance online canada

- cheapest car insurance ontario

- intact car insurance

- Car Insurance 2024 Canada